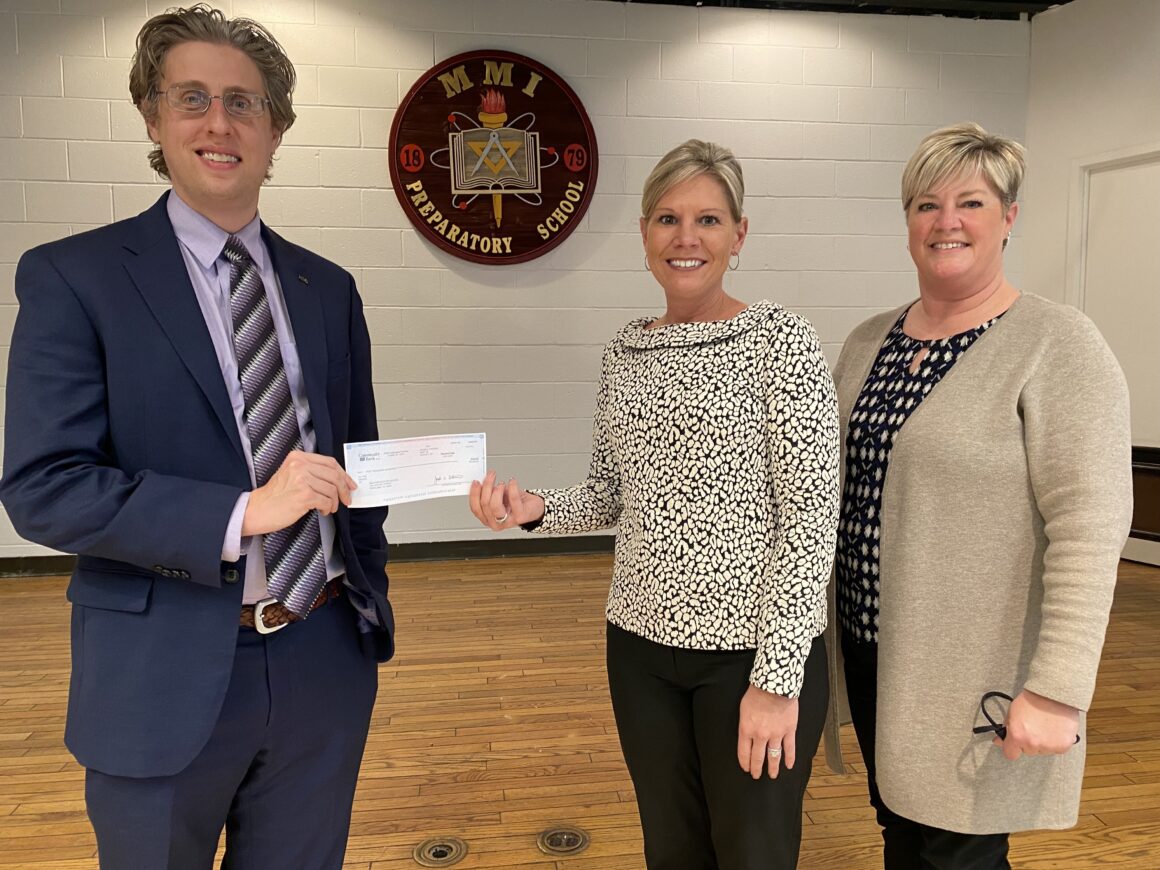

Pictured are, from left: Justin Kleinheider, MMI Head of School, Alison Zurawski, Community Relations Manager at Community Bank, N.A and Kim McNulty, Director of Advancement at MMI.

MMI Preparatory School recently received a $5,000 contribution from Community Bank, N.A. through the Education Improvement Tax Credit (EITC) program to go toward need-based scholarships at the school.

MMI Director of Advancement Kim McNulty said, “On behalf of everyone at MMI Preparatory School, I’d like to thank Community Bank for their generous contribution. Support of MMI through the state’s tax credit programs helps our effort to make our educational experience available to the most capable students regardless of their financial circumstances.”

Alison Zurawski, Community Relations Manager at Community Bank, N.A., said, “Providing MMI Preparatory School with this contribution will help them continue their mission to provide a quality education to students. Community Bank is honored to be able to present the School with this donation.”

As an approved scholarship organization, MMI is designated to receive contributions through the EITC program, which is administered by the Pennsylvania Department of Community and Economic Development. Businesses that donate to MMI are eligible to receive tax credits amounting to 75 percent of their charitable contribution for a one-year period. The tax credit increases to 90 percent if the company commits to making the same donation for two consecutive years. Pennsylvania is one of only a few states in the nation that offers the EITC program, which gives tax credits to eligible businesses contributing to a scholarship organization.

Community Bank System, Inc. operates more than 234 customer facilities across Upstate New York, Northeastern Pennsylvania, Vermont, and Western Massachusetts through its banking subsidiary, Community Bank, N.A. With assets of over $11.0 billion, the DeWitt, N.Y. headquartered company is among the country’s 150 largest financial institutions. In addition to a full range of retail, business, and municipal banking services, the Company offers comprehensive financial planning and wealth management services through its Community Bank Wealth Management Group and OneGroup NY, Inc. operating units. The Company’s Benefit Plans Administrative Services, Inc. subsidiary is a leading provider of employee benefits administration, trust services, collective investment fund administration and actuarial consulting services to customers on a national scale. Community Bank System, Inc. is listed on the New York Stock Exchange and the Company’s stock trades under the symbol CBU. For more information about Community Bank visit www.cbna.com or http://ir.communitybanksystem.com.

For more information about the Education Improvement Tax Credit program, contact Kim McNulty at 570-636-1108 or kmcnulty@mmiprep.org.